(with Pablo Cuba-Borda and Frank Schorfheide)

Published in Review of Economic Studies, 2018, 85, 87-118.

Previously circulated under the title “Macroeconomic Dynamics Near the ZLB: A Tale of Two Equilibria”.

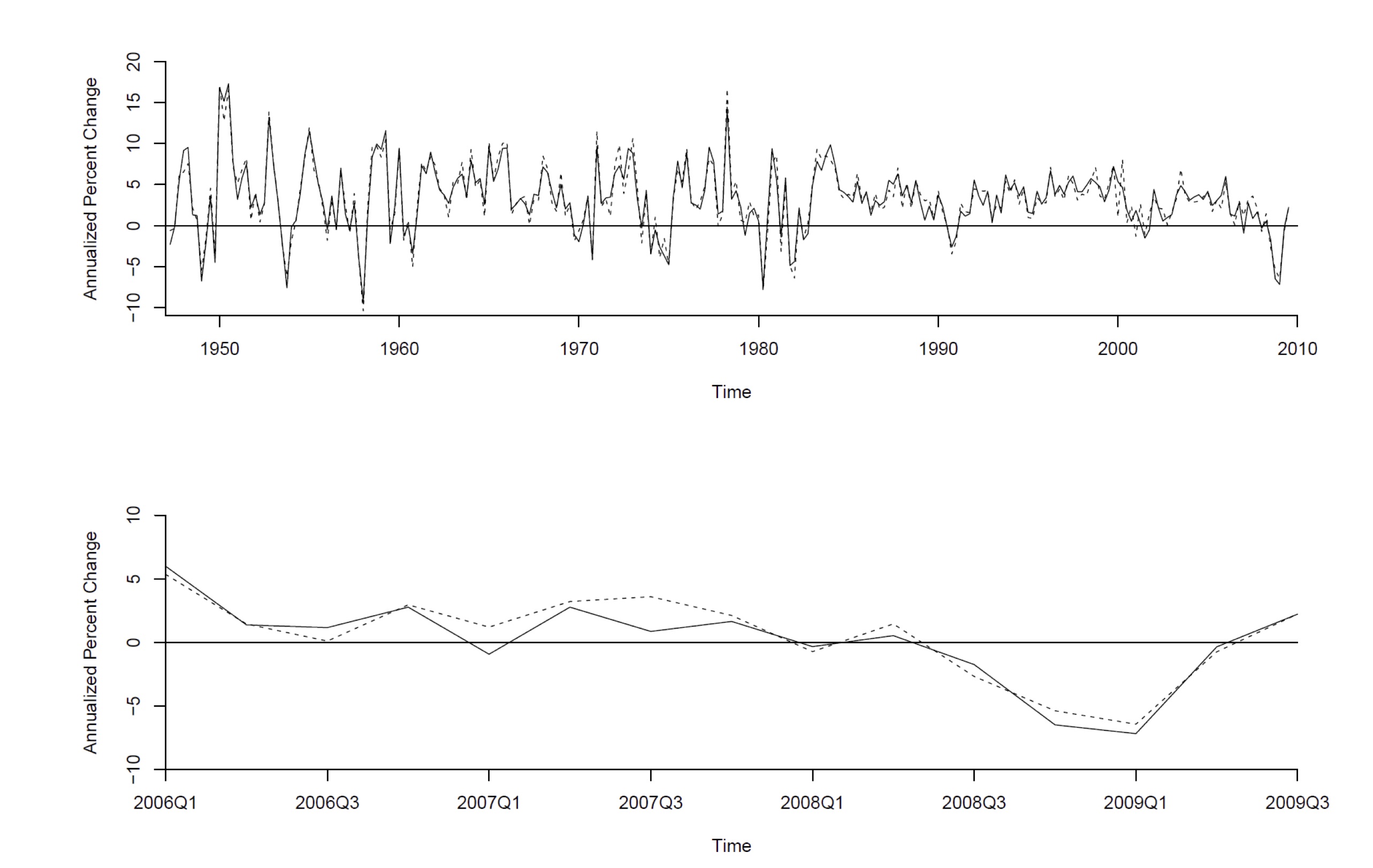

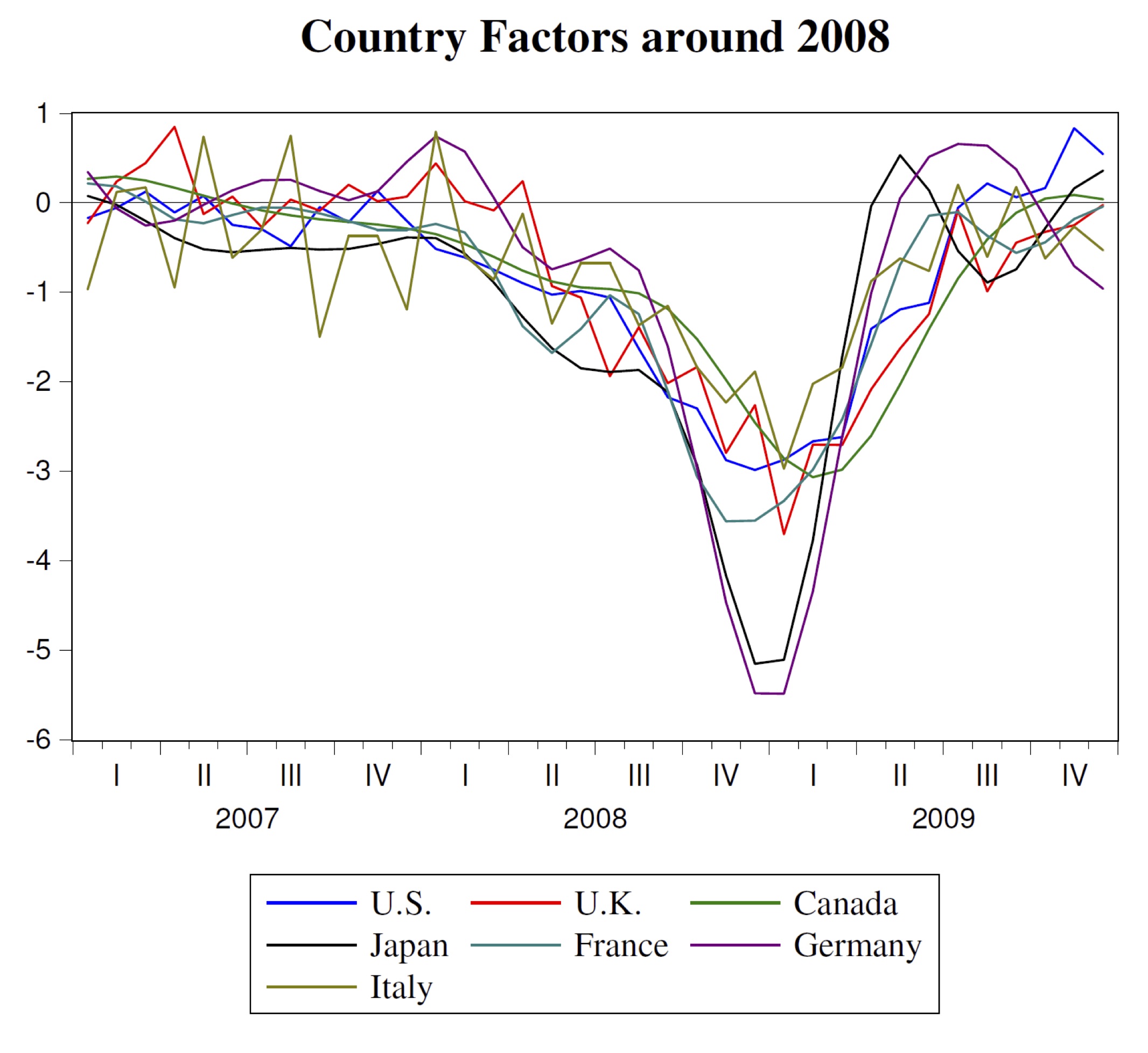

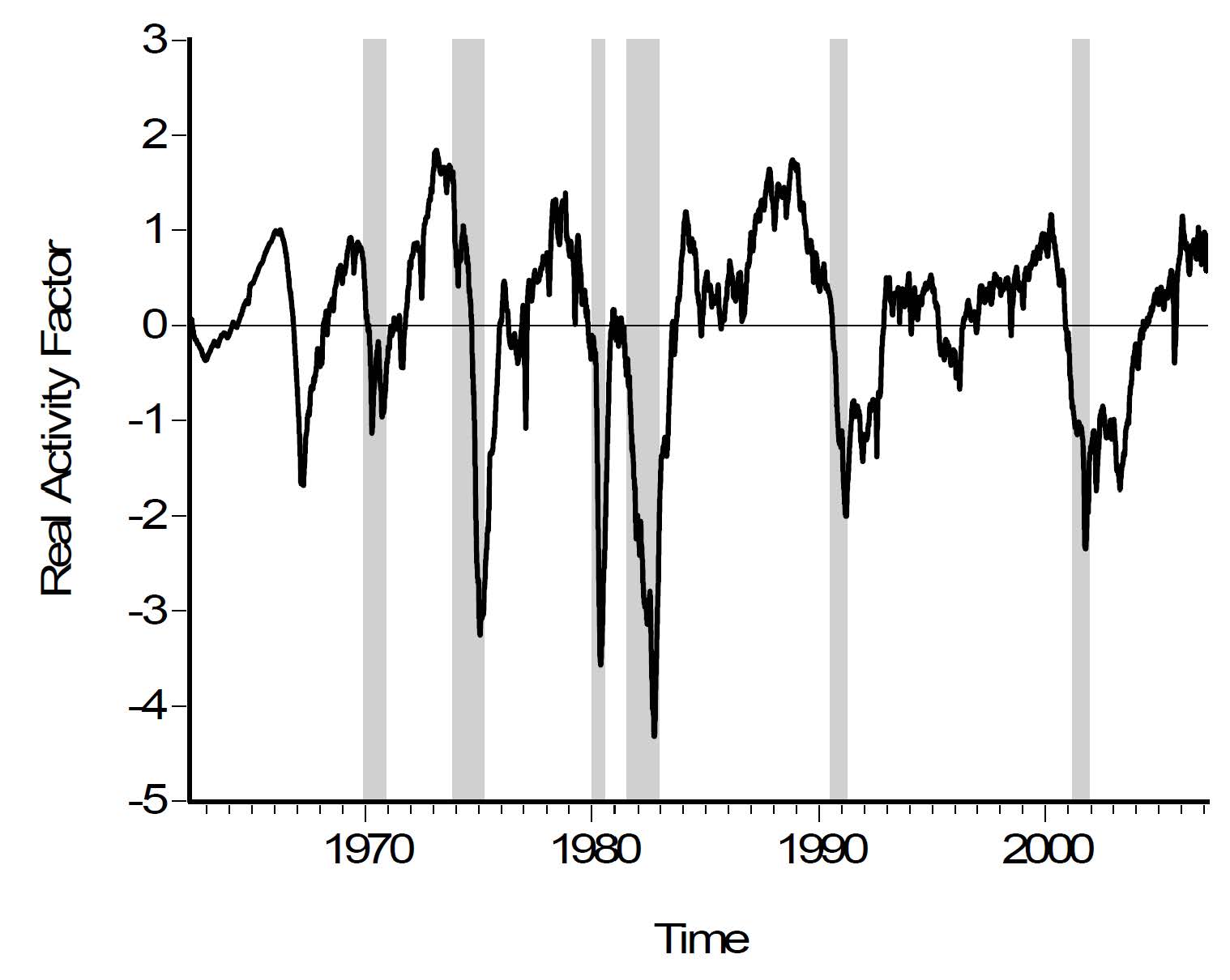

We compute a sunspot equilibrium in an estimated small-scale New Keynesian model with a zero lower bound (ZLB) constraint on nominal interest rates and a full set of stochastic fundamental shocks. In this equilibrium a sunspot shock can move the economy from a regime in which inflation is close to the central bank’s target to a regime in which the central bank misses its target, inflation rates are negative, and interest rates are close to zero with high probability. A nonlinear filter is used to examine whether the U.S. in the aftermath of the Great Recession and Japan in the late 1990s transitioned to a deflation regime. The results are somewhat sensitive to the model specification, but on balance, the answer is affirmative for Japan and negative for the U.S.

First draft : September 2012

Paper

NBER Working Paper (old version) [June 2014]

Federal Reserve Bank of Philadelphia Working Paper (old version) [July 2013]

Federal Reserve Bank of Philadelphia Working Paper [May 2016]

Most Recent Working Paper [December 2016]

Additional Material