(with Andres Fernandez, Daniel Guzman, Ernesto Pasten, and Felipe Saffie)

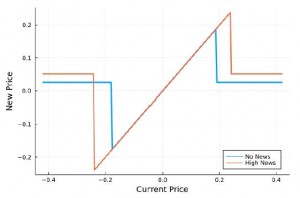

Uncertainty triggers two confounding effects: a realization and an anticipation effect. By using the 2019 riots in Chile as a quasi-natural experiment, we show that the pricing behavior of supermarkets is consistent with a pure anticipation effect: during the 31-day period following the start of the Riots, supermarkets reduce the frequency of price changes and, conditional on a price change, the absolute magnitude of price changes increase. A quantitative menu cost model with news about a future increase in idiosyncratic demand dispersion can deliver these pricing dynamics. The effectiveness of monetary policy crucially depends on the timing of the intervention.

First Draft : December 2021

Paper

Most Recent Working Paper [January 2024]