(with Luigi Bocola and Frank Schorfheide)

Published in Journal of Economic Dynamics and Control, 2017, 83, 34-54.

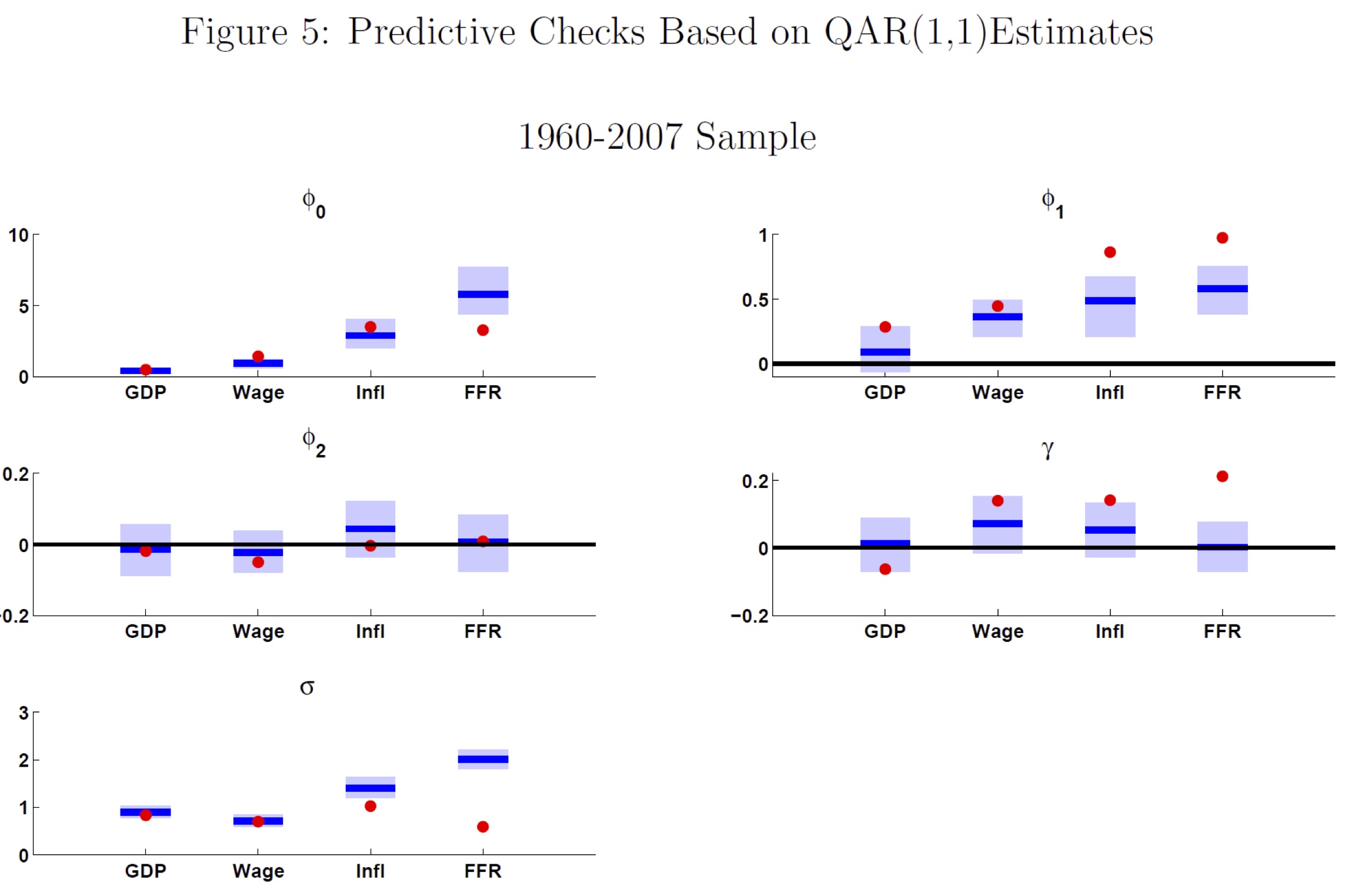

We develop a new class of time series models to identify nonlinearities in the data and to evaluate DSGE models. U.S. output growth and the federal funds rate display nonlinear conditional mean dynamics, while inflation and nominal wage growth feature conditional heteroskedasticity. We estimate a DSGE model with asymmetric wage and price adjustment costs and use predictive checks to assess its ability to account for nonlinearities. While it is able to match the nonlinear inflation and wage dynamics, thanks to the estimated downward wage and price rigidities, these do not spill over to output growth or the interest rate.

First draft : October 2011

Paper

Most Recent Working Paper [July 2017]

Published Version (requires subscription)

Federal Reserve Bank of Philadelphia Working Paper [November 2013]

NBER Working Paper 19693 [December 2013]