(with Eugene Oue, Felipe Saffie and Jon Willis)

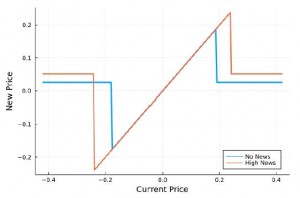

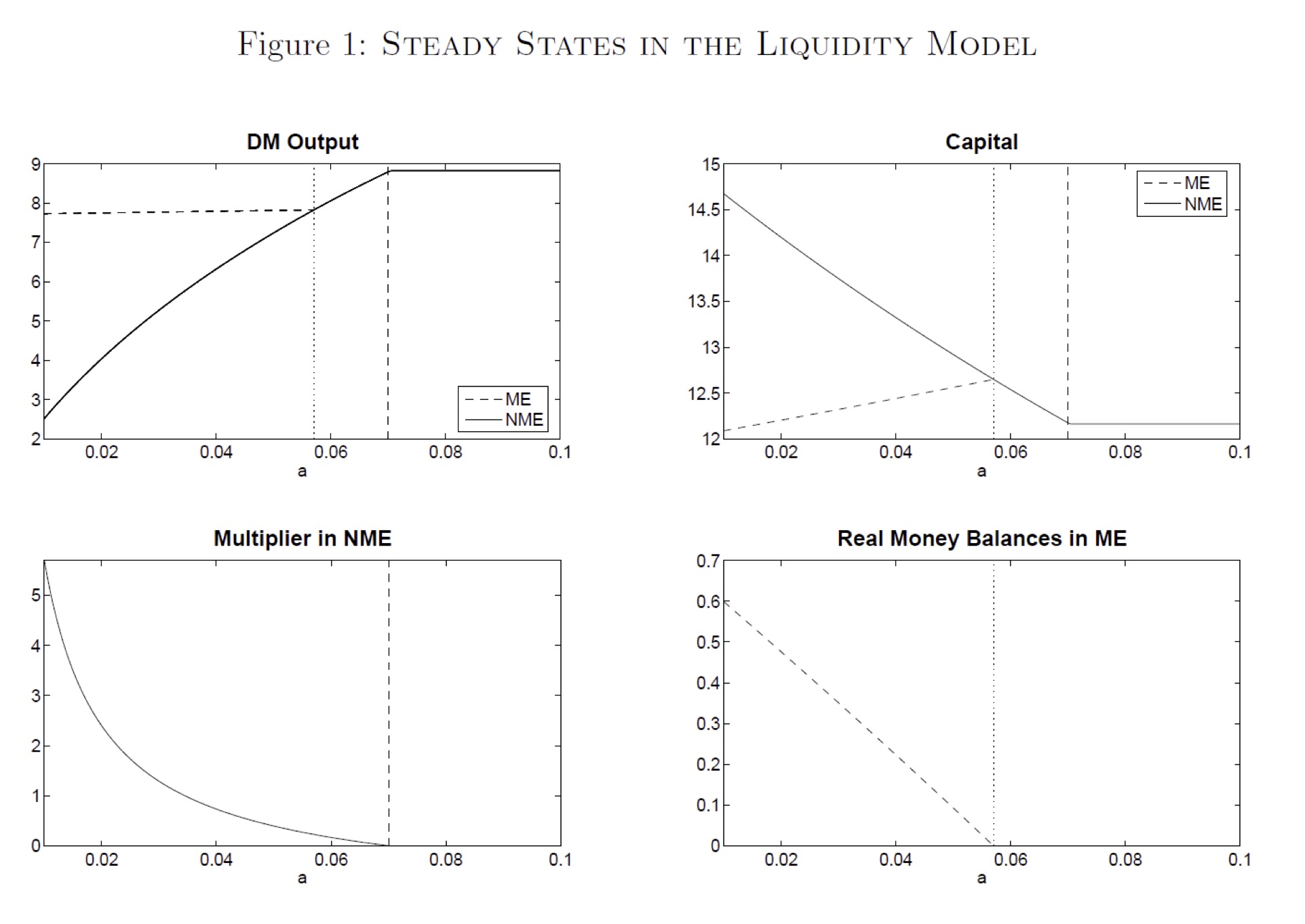

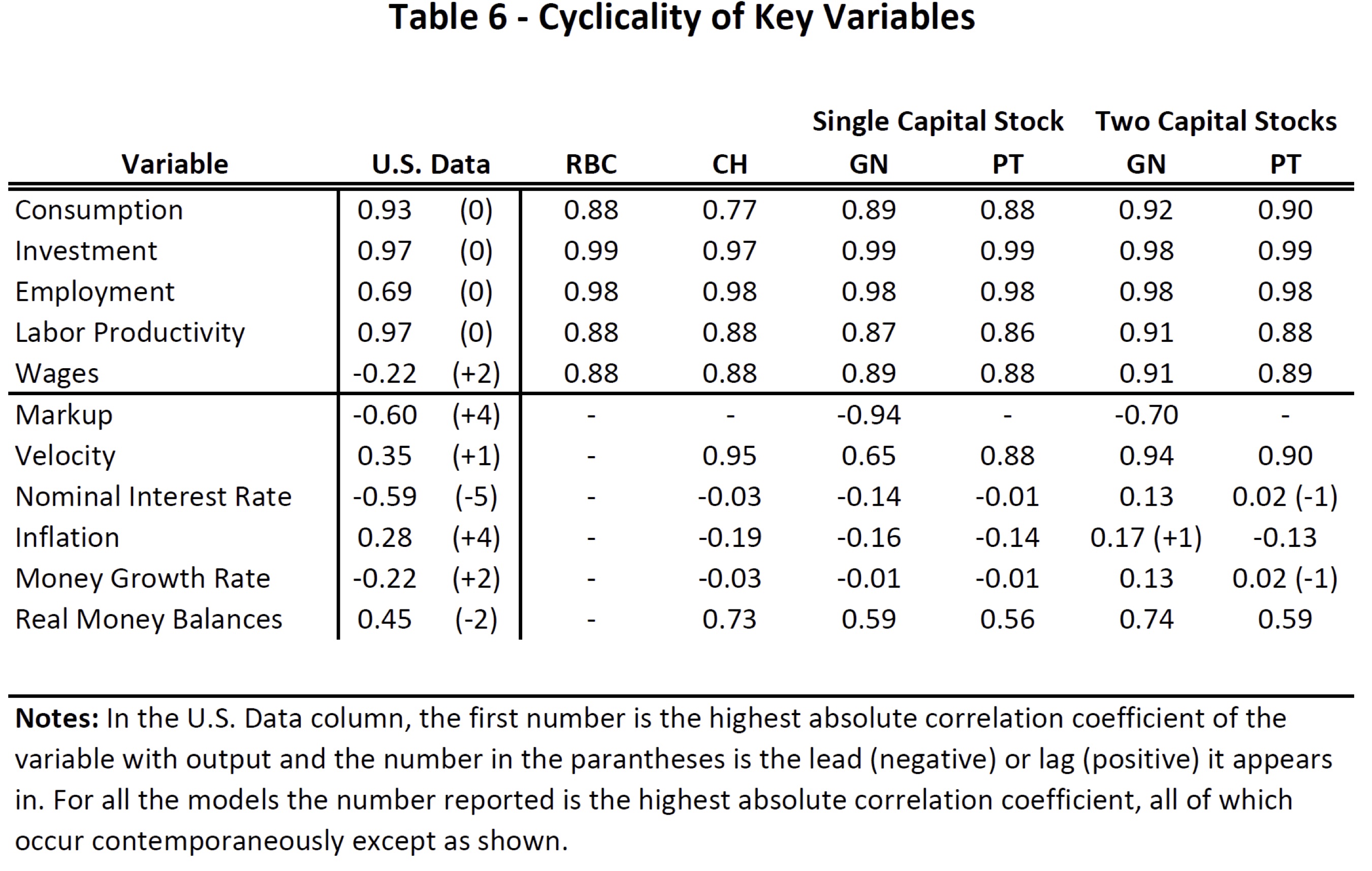

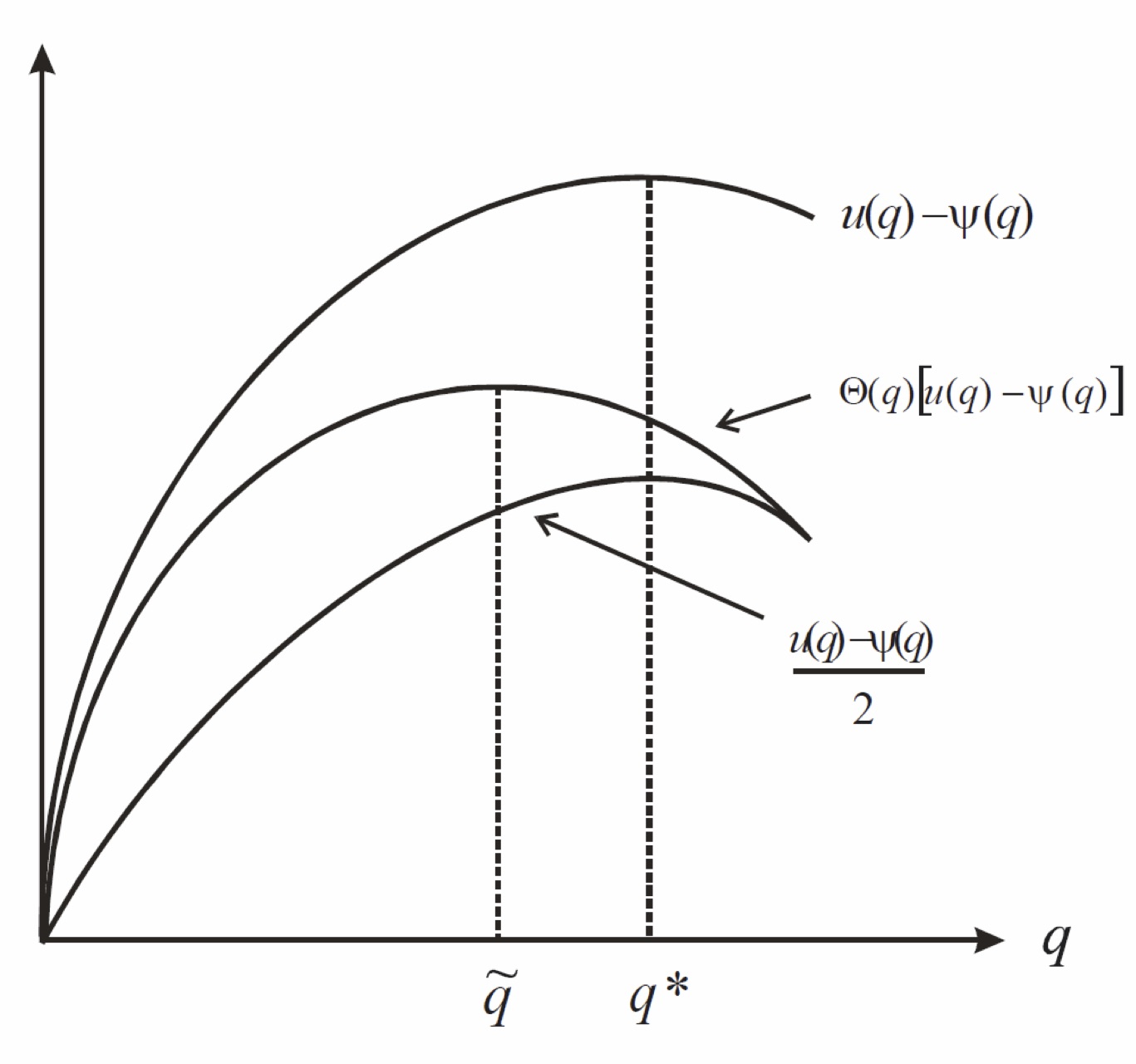

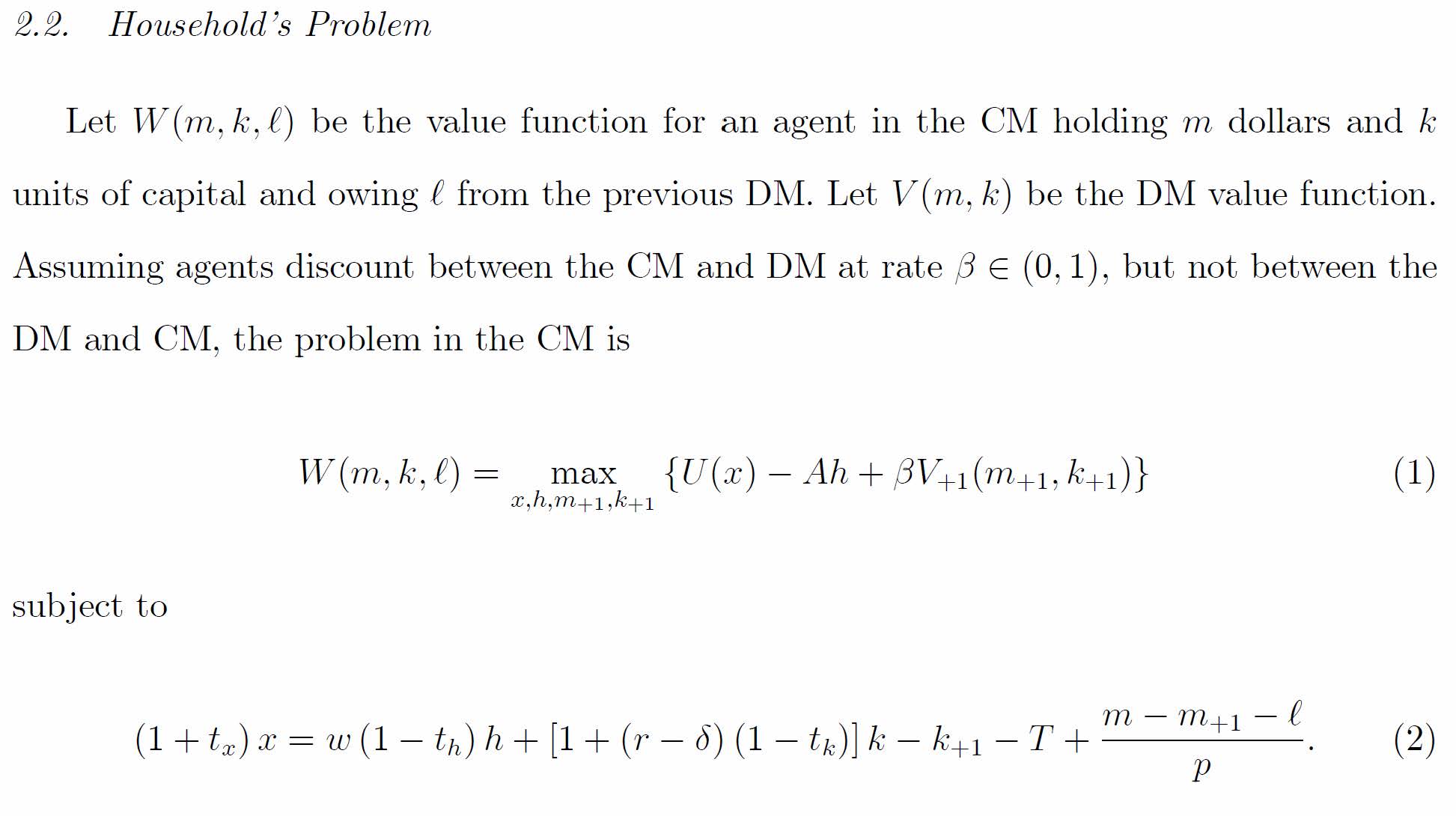

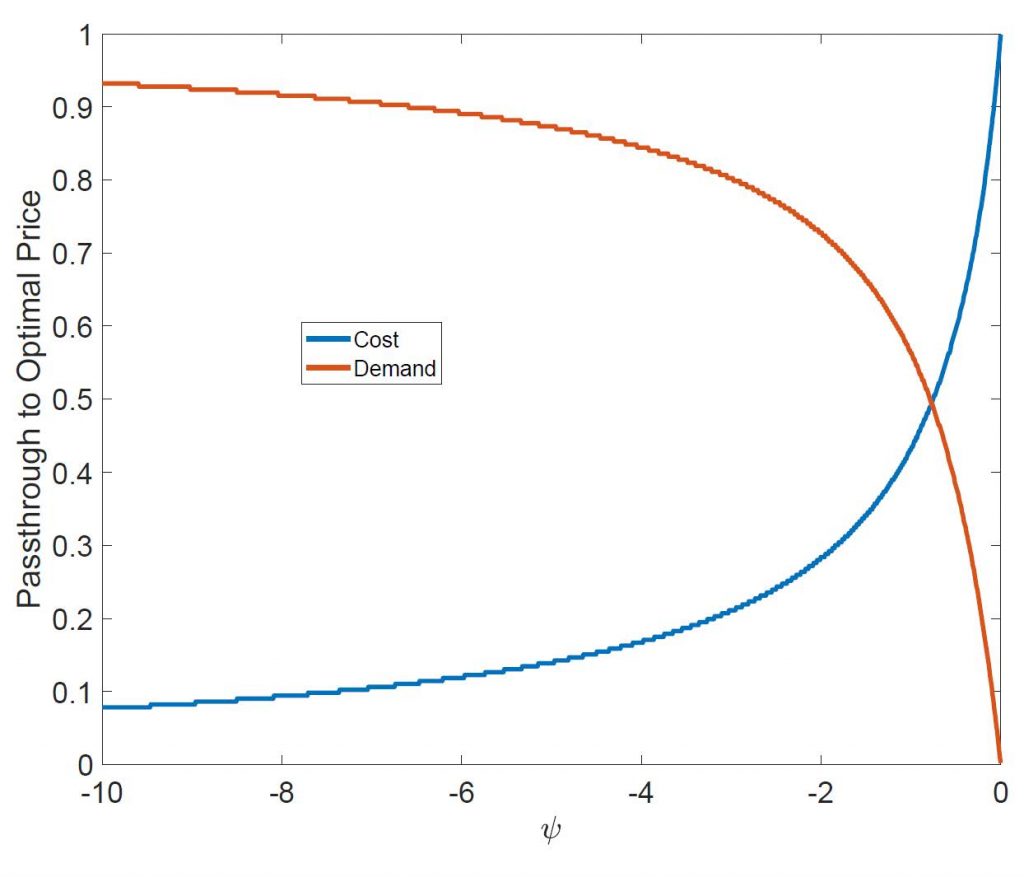

We develop a simple menu-cost model with non-constant elasticity of demand that features idiosyncratic productivity and demand shocks. The model is calibrated to match firm-level productivity and demand processes estimated from U.S. data. Despite its simplicity, the calibrated model delivers untargeted pricing dynamics and a markup distribution that are consistent with U.S. micro data. Moreover, it also generates sizable monetary non-neutrality that rivals more complicated alternative menu cost models that explicitly target pricing dynamics. The key in reconciling firm and pricing dynamics comes from the interaction between non-constant elasticity of demand and idiosyncratic demand shocks. Thus, this framework effortlessly unifies pricing, markup, and firm dynamics.

First Draft : December 2022

Paper

Most Recent Working Paper [February 2024]

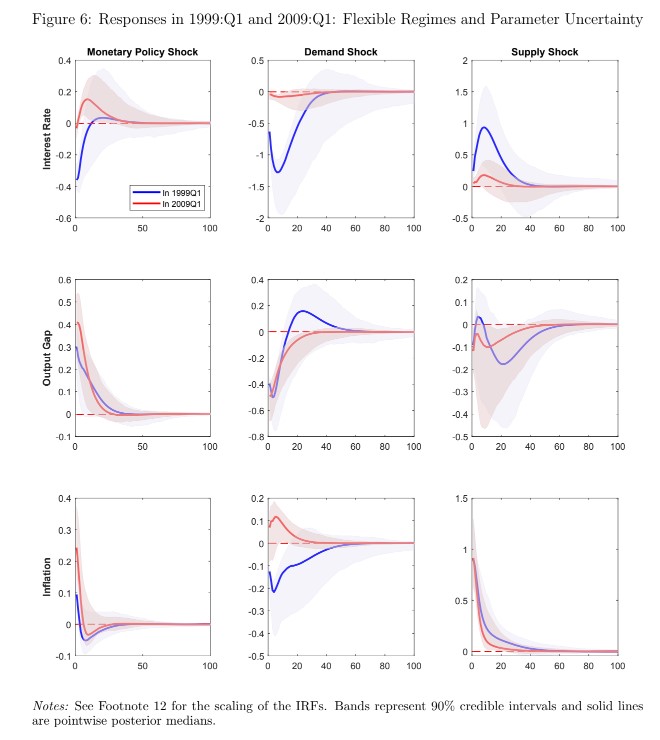

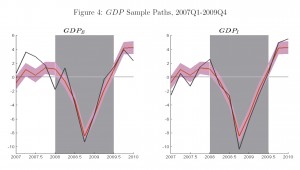

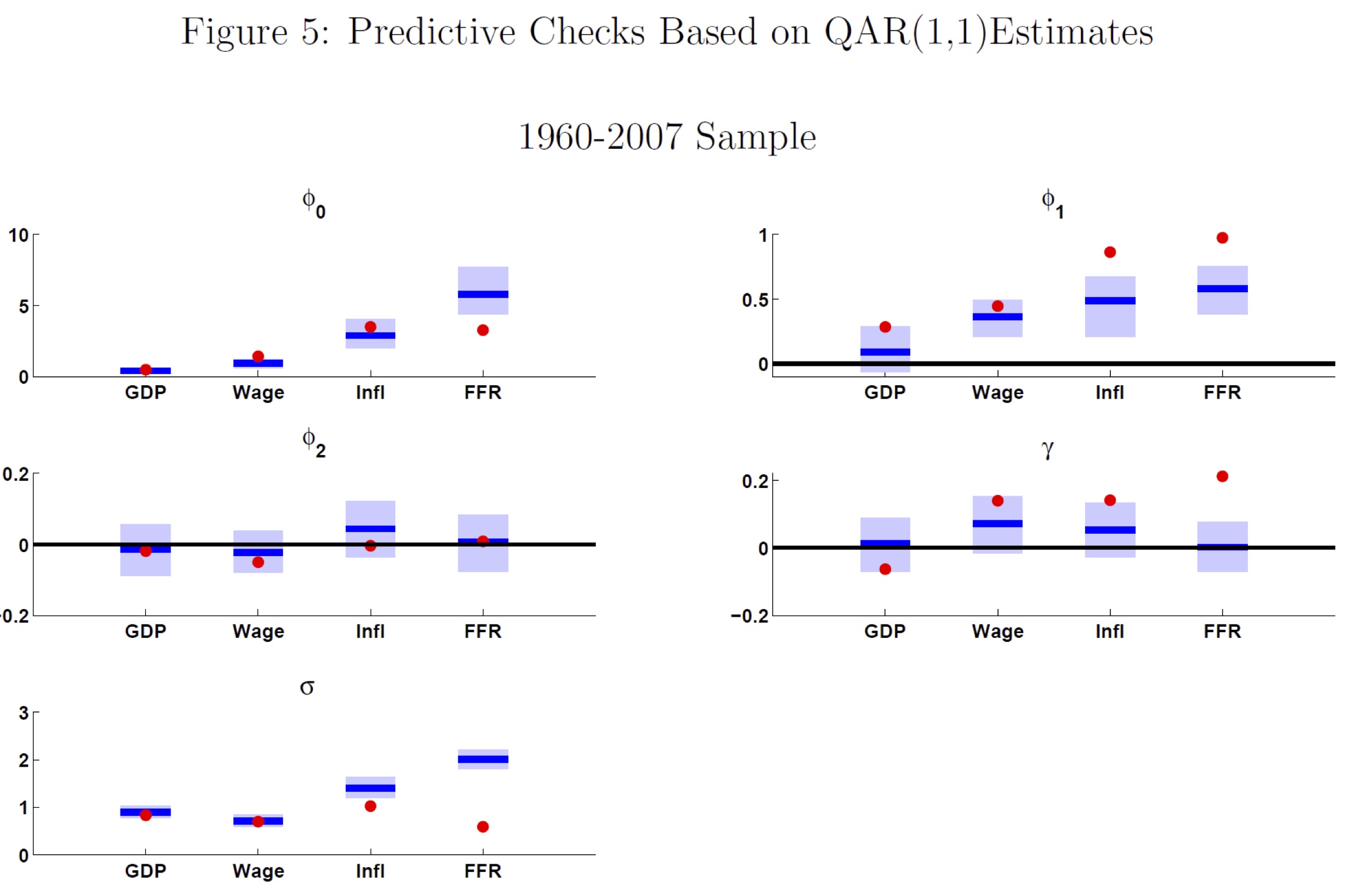

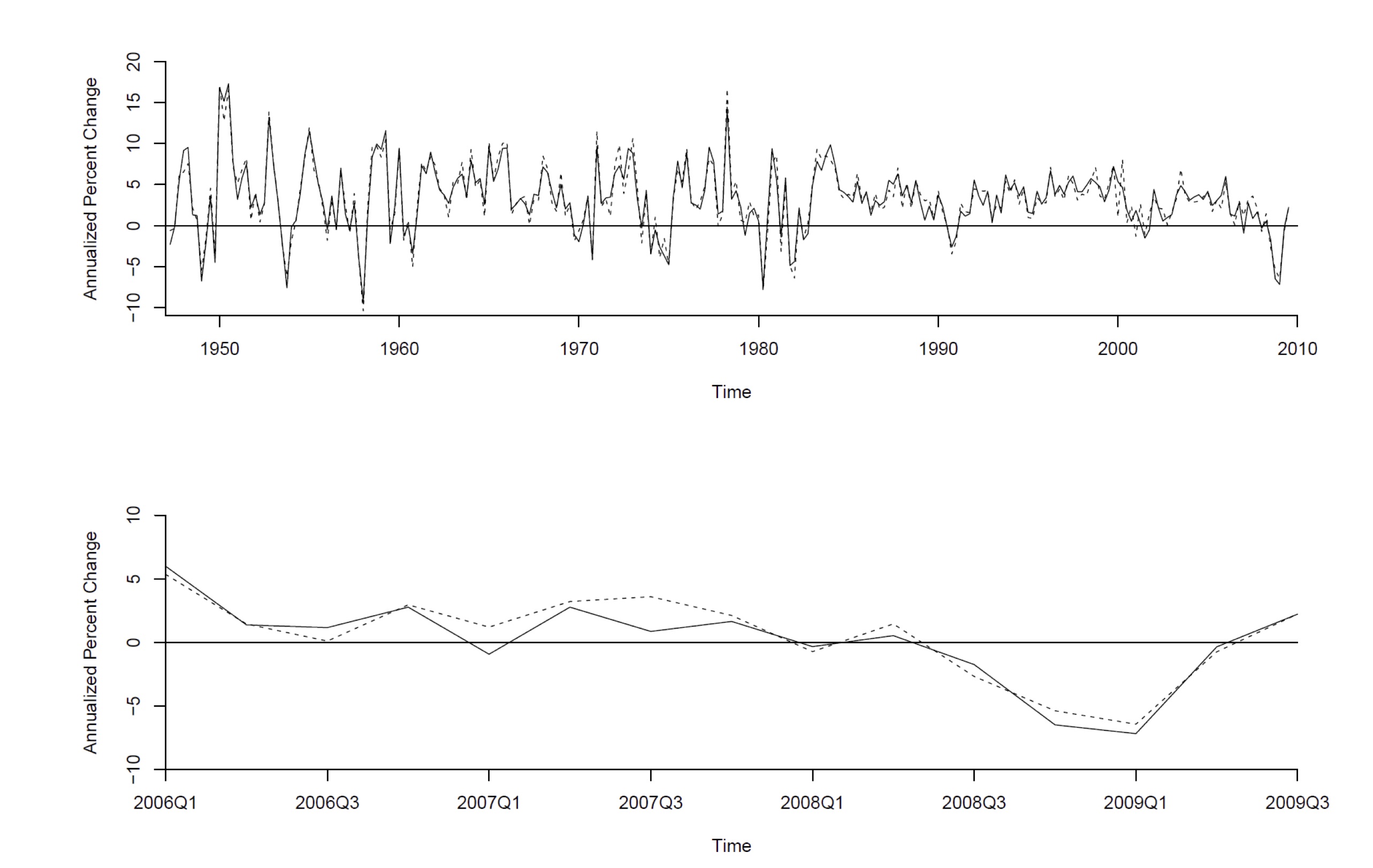

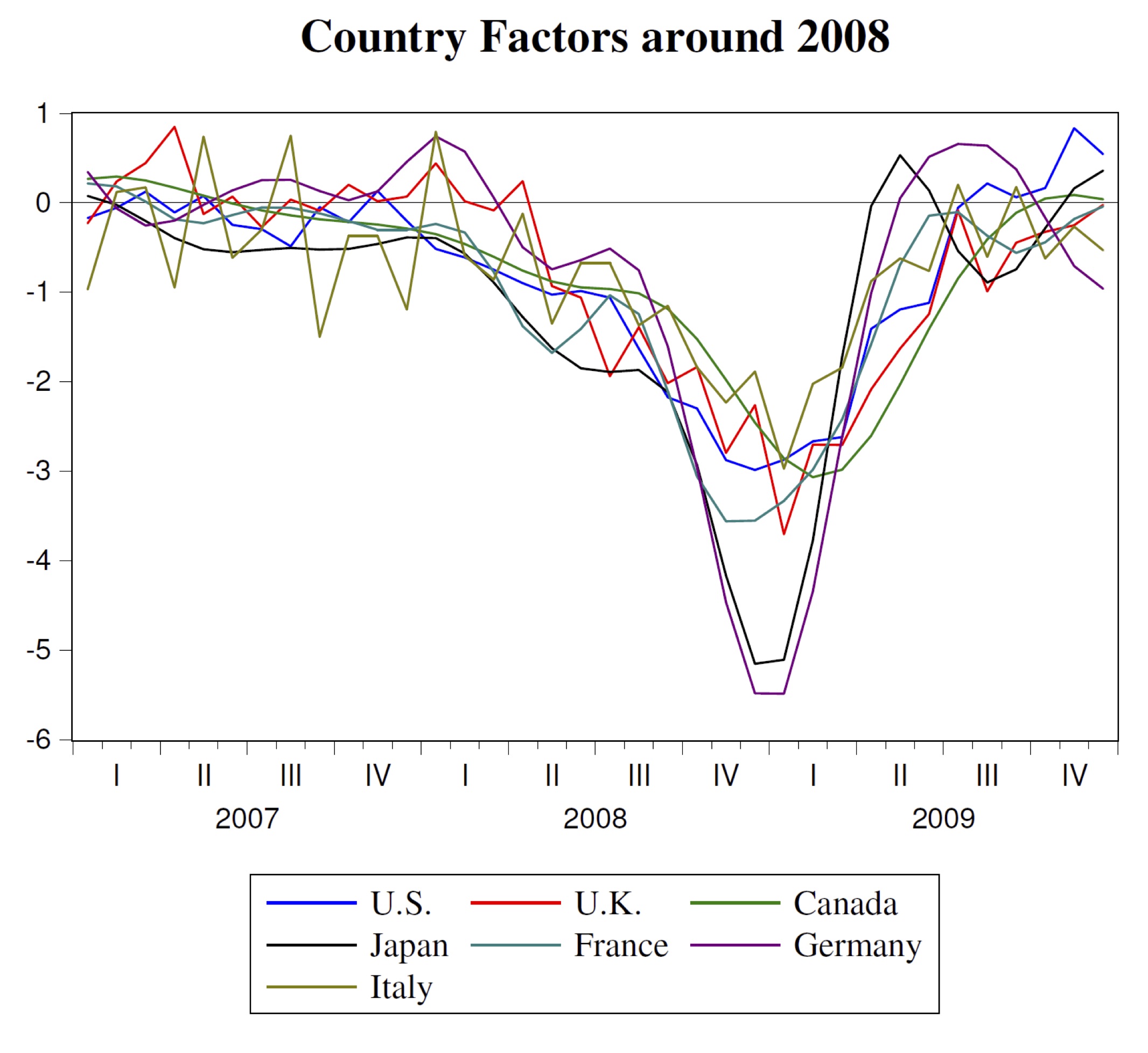

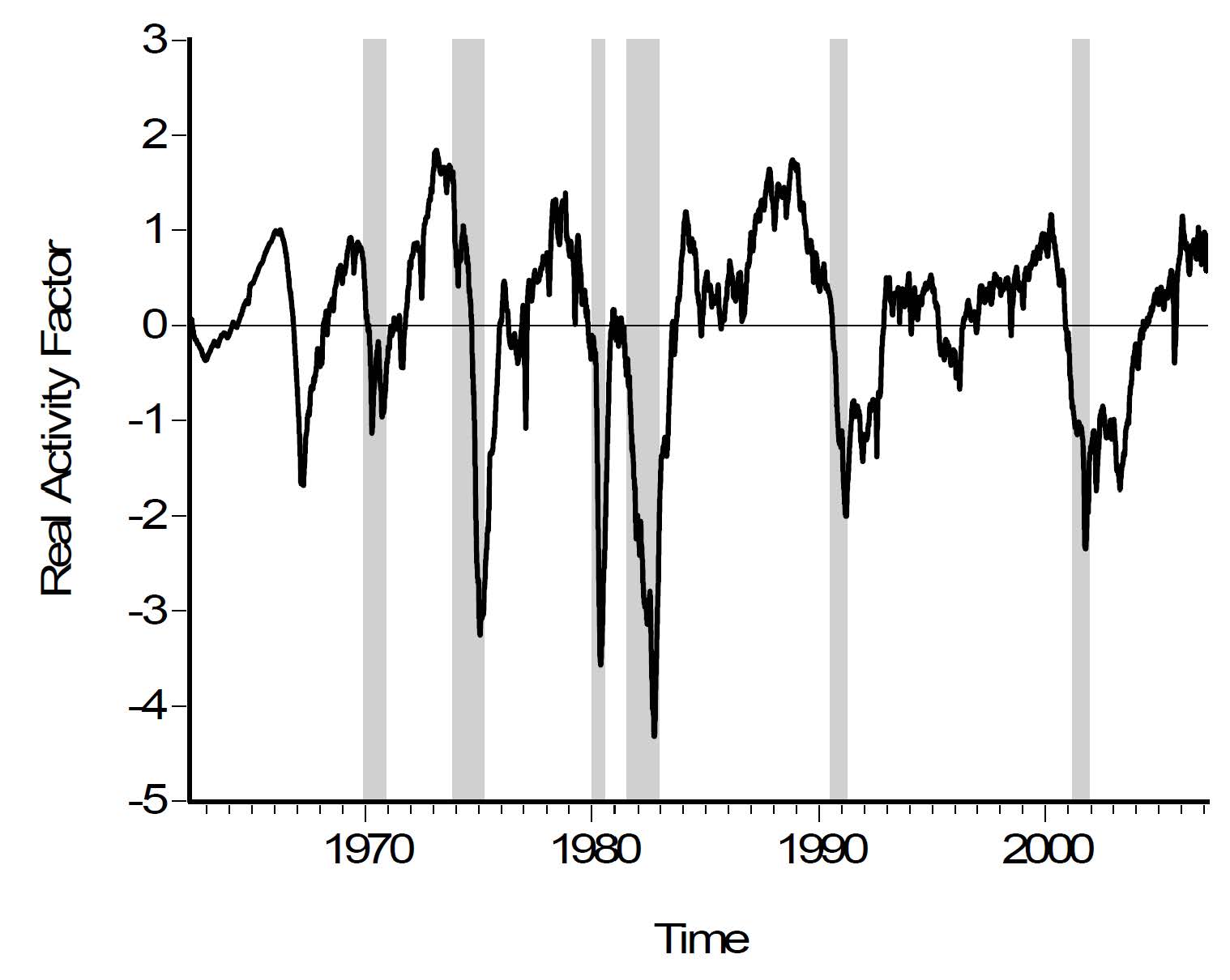

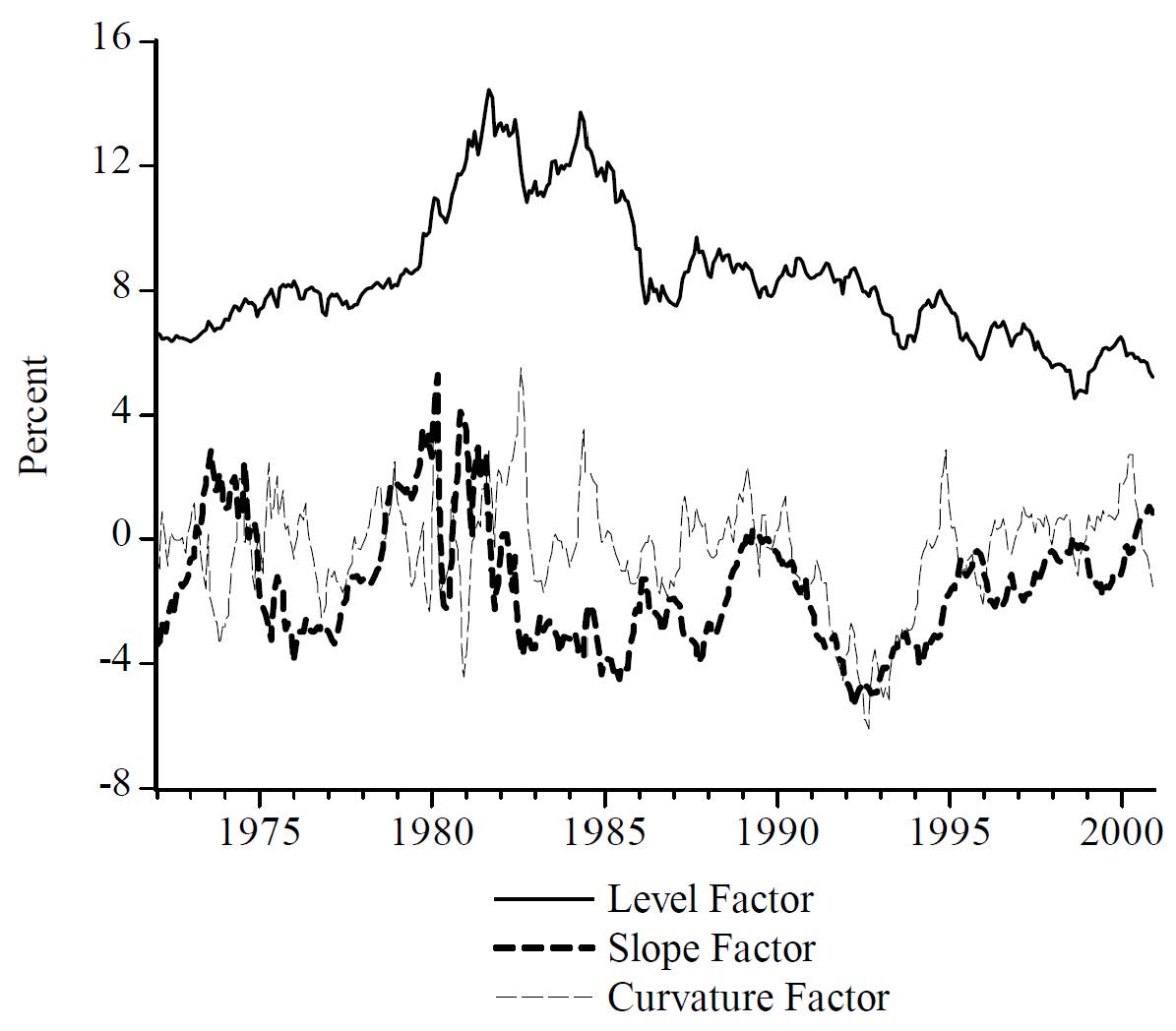

We develop a novel method for the identification of monetary policy shocks. By applying natural language processing techniques to documents that Federal Reserve staff prepare in advance of policy decisions, we capture the Fed’s information set. Using machine learning techniques, we then predict changes in the target interest rate conditional on this information set and obtain a measure of monetary policy shocks as the residual. We show that the documents’ text contains essential information about the economy which is not captured by numerical forecasts that the staff include in the same documents. The dynamic responses of macro variables to our monetary policy shocks are consistent with the theoretical consensus. Shocks constructed by only controlling for the staff forecasts imply responses of macro variables at odds with theory. We directly link these differences to the information that our procedure extracts from the text over and above information captured by the forecasts.

We develop a novel method for the identification of monetary policy shocks. By applying natural language processing techniques to documents that Federal Reserve staff prepare in advance of policy decisions, we capture the Fed’s information set. Using machine learning techniques, we then predict changes in the target interest rate conditional on this information set and obtain a measure of monetary policy shocks as the residual. We show that the documents’ text contains essential information about the economy which is not captured by numerical forecasts that the staff include in the same documents. The dynamic responses of macro variables to our monetary policy shocks are consistent with the theoretical consensus. Shocks constructed by only controlling for the staff forecasts imply responses of macro variables at odds with theory. We directly link these differences to the information that our procedure extracts from the text over and above information captured by the forecasts.