(with Christopher J. Waller and Randall D. Wright)

Published in Journal of Monetary Economics, March 2011, 58, 98-116

Also circulated as “Money and Capital: A Quantitative Analysis”.

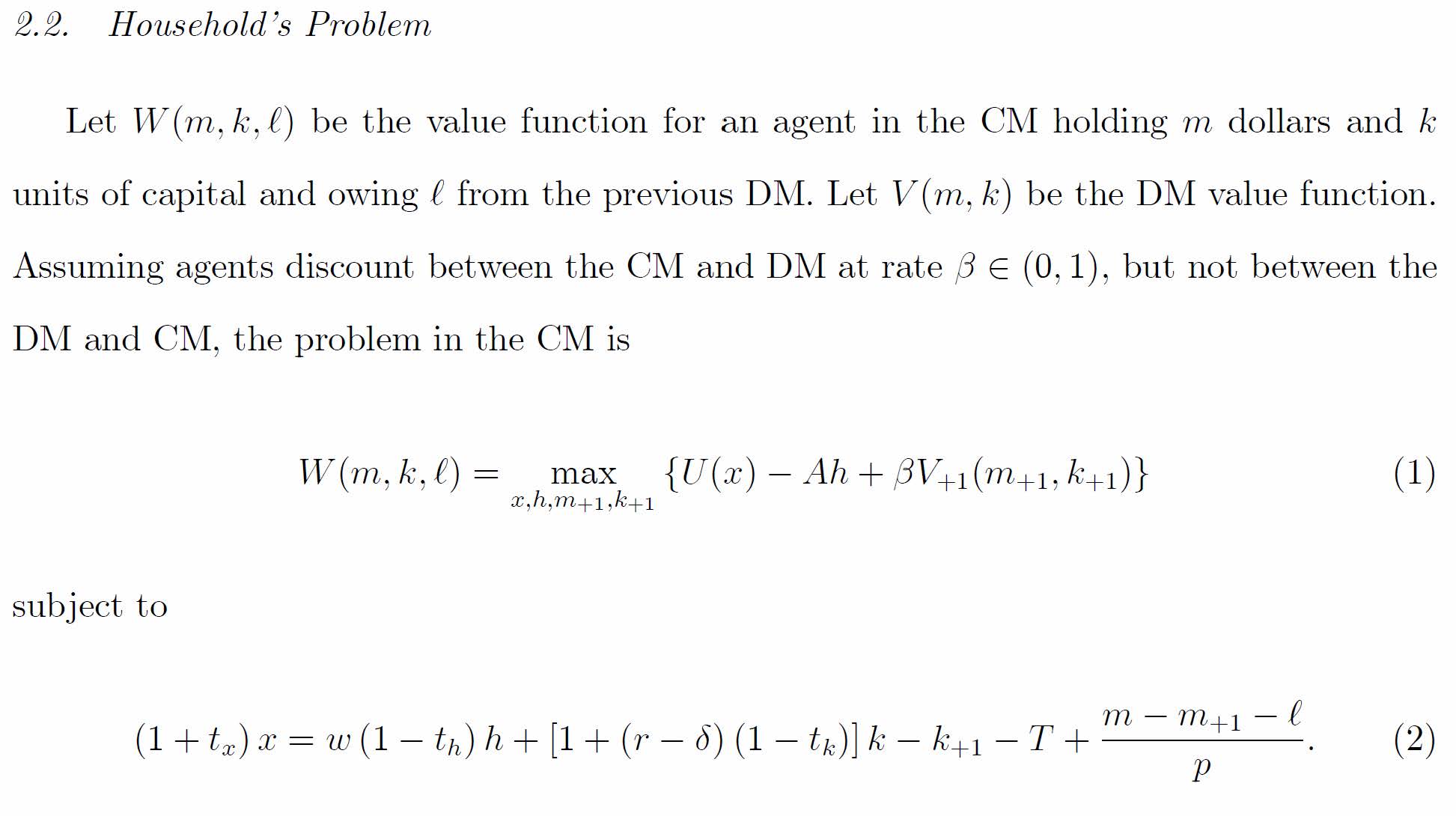

The effects of money (anticipated inflation) on capital formation is a classic issue in macroeconomics. Previous papers adopt reduced-form approaches, putting money in the utility function, or imposing cash in advance, but using otherwise frictionless models. We follow instead a literature that tries to be explicit about the frictions making money essential. This introduces new elements, including a two-sector structure with centralized and decentralized markets, stochastic trading opportunities, and bargaining. These elements matter quantitatively and numerical results differ from findings in the reduced-form literature. The analysis also reduces a gap between microfounded monetary economics and mainstream macro.

First Draft : 2005

Paper

Most Recent Working Paper (may not be identical to the published version)