(with Pablo Cuba-Borda and Frank Schorfheide)

Draft Coming Soon.

(with Pablo Cuba-Borda and Frank Schorfheide)

Draft Coming Soon.

(with Thomas Drechsel)

We develop a novel method for the identification of monetary policy shocks. By applying natural language processing techniques to documents that Federal Reserve staff prepare in advance of policy decisions, we capture the Fed’s information set. Using machine learning techniques, we then predict changes in the target interest rate conditional on this information set and obtain a measure of monetary policy shocks as the residual. We show that the documents’ text contains essential information about the economy which is not captured by numerical forecasts that the staff include in the same documents. The dynamic responses of macro variables to our monetary policy shocks are consistent with the theoretical consensus. Shocks constructed by only controlling for the staff forecasts imply responses of macro variables at odds with theory. We directly link these differences to the information that our procedure extracts from the text over and above information captured by the forecasts.

We develop a novel method for the identification of monetary policy shocks. By applying natural language processing techniques to documents that Federal Reserve staff prepare in advance of policy decisions, we capture the Fed’s information set. Using machine learning techniques, we then predict changes in the target interest rate conditional on this information set and obtain a measure of monetary policy shocks as the residual. We show that the documents’ text contains essential information about the economy which is not captured by numerical forecasts that the staff include in the same documents. The dynamic responses of macro variables to our monetary policy shocks are consistent with the theoretical consensus. Shocks constructed by only controlling for the staff forecasts imply responses of macro variables at odds with theory. We directly link these differences to the information that our procedure extracts from the text over and above information captured by the forecasts.

First Draft : March 2022

Paper

Most Recent Working Paper [December 2023]

(with Andres Fernandez, Daniel Guzman, Ernesto Pasten, and Felipe Saffie)

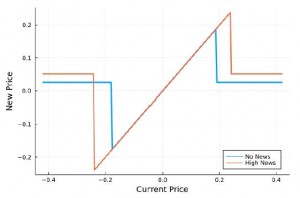

Uncertainty triggers two confounding effects: a realization and an anticipation effect. By using the 2019 riots in Chile as a quasi-natural experiment, we show that the pricing behavior of supermarkets is consistent with a pure anticipation effect: during the 31-day period following the start of the Riots, supermarkets reduce the frequency of price changes and, conditional on a price change, the absolute magnitude of price changes increase. A quantitative menu cost model with news about a future increase in idiosyncratic demand dispersion can deliver these pricing dynamics. The effectiveness of monetary policy crucially depends on the timing of the intervention.

First Draft : December 2021

Paper

Most Recent Working Paper [January 2024]

(with Frank Schorfheide, Marko Mlikota, and Sergio Villalvazo)

Forthcoming in Journal of Econometrics.

We develop a structural VAR in which an occasionally-binding constraint generates censoring of one of the dependent variables. Once the censoring mechanism is triggered, we allow some of the coefficients for the remaining variables to change. We show

that a necessary condition for a unique reduced form is that regression functions for the non-censored variables are continuous at the censoring point and that parameters satisfy some mild restrictions. In our application the censored variable is a nominal interest rate constrained by an effective lower bound (ELB). According to our estimates based on U.S. data, once the ELB becomes binding, the coefficients in the inflation equation change significantly, which translates into a change of the inflation responses to (unconventional) monetary policy and demand shocks. Our results suggest that the presence of the ELB is indeed empirically relevant for the propagation of shocks. We also obtain a shadow interest rate that shows a significant accommodation in the early parts of the Great Recession, followed by a mild and steady accommodation until liftoff

in 2016.

First draft : May 2020

Paper

Most Recent Working Paper [June 2021]

NBER Working Paper 28571 [March 2021]

Additional Materials

(with Morris A. Davis and Randall Wright)

Published in Review of Economic Dynamics, July 2016, 21, 105-124.

We introduce household production and the production of houses (construction) into a monetary model. Theory predicts inflation, as a tax on market activity, encourages substitution into household production and hence investment in housing. In the model, the stock and appropriately-deflated price of housing increase with inflation or nominal interest rates. We document this in data for the U.S. and other countries. A calibrated model accounts for up to 52% (87%) of the relationship between interest rates and housing wealth deflated by nominal output (by the money supply). It also implies the cost of inflation is higher than in models without home production.

First draft : March 2011

Paper

NBER Working Paper 18276 [August 2012]

Most Recent Working Paper (may not be identical to the published version)

Published Version (requires subscription)

(with Frank Schorfheide)

We have no current plans of revising or publishing this paper. It is meant to be an extension of Aruoba and Schorfheide (2011).

In this note we extend the search-based monetary DSGE model studied in Aruoba and Schorfheide (2010) and introduce liquid capital claims. More specifically, buyers in the decentralized market can use a fraction of their capital stock holdings in addition to money to acquire goods from sellers. We show that if liquid capital is a small fraction of the overall capital then money and capital claims can co-exist as a medium of exchange in the decentralized market. Our analysis extends earlier work by Lagos and Rochetau to an environment in which capital is used as a factor of production in the decentralized market. We then estimate our model using Bayesian methods. We find that the estimated fraction of capital that is liquid is close to zero, which means that the data favor the specification without liquid capital, studied in Aruoba and Schorfheide (2010).

First draft : January 2010

Paper

Working Paper [January 2010]

Previously circulated under the title “Informal Sector, Government Policy and Institutions”

Previously circulated under the title “Informal Sector, Government Policy and Institutions”

Published in Journal of Monetary Economics, 2021, 118, 212-229.

The mix of inflation and income taxation that governments adopt vary considerably across countries. We take a Ramsey optimal-policy approach to explain these differences, focusing on the institutions of the country, modeled as the difficulty of tax evasion, as the key variation across countries. In our model households optimally choose the extent of informal activity and a benevolent government optimally chooses policies, both taking as given the institutions of the economy. The model matches qualitatively the observed relationships between institutions and inflation, taxes and tax evasion. In a cross-country quantitative exercise with 125 countries, the model delivers a good fit: the correlation of data and model-generated values for inflation and taxes are 0.42 and 0.78, respectively.

First Draft : September 2009

Paper

Most Recent Working Paper [July 2018]

Published Version (requires subscription)

Press Mentions

Econ Browser (James Hamilton’s Blog) [May 16, 2010]

Wall Street Journal Website [May 17, 2010]

Published in International Economic Review, August 2011, 52(3), 935-959.

Monetary models that specify explicit frictions to generate money demand have been developed over the last 20 years and have been used to address many questions. In this article, I investigate the short-run properties of a particular model considering a number of versions based on some modeling choices. All versions feature flexible prices. I find that in many aspects, both real and nominal, the model resembles other, more reduced-form models. Some variations of the model come closer to matching some key nominal facts than a reduced-form model. The model also generates counter cyclical markups, in line with the data.

First Draft : November 2009

Most Recent Working Paper (may not be identical to the published version)

Published Version (requires subscription)

(with Frank Schorfheide)

Also circulated as “Insights from an Estimated Search Model of Money with Nominal Rigidities”.

Published in American Economic Journal: Macroeconomics, January 2011, 3, 60-90.

We develop a two-sector monetary model with a centralized and decentralized market. Activities in the centralized market resemble those in a standard New Keynesian economy with price rigidities. In the decentralized market agents engage in bilateral exchanges for which money is essential. This paper is the first to formally estimate such a model, evaluate its fit based on postwar U.S. data, and assess its money demand properties. Steady state welfare calculations reveal that the distortions created by the monetary friction may be of similar magnitude as the distortions created by the New Keynesian friction.

First draft : October 2007

Paper

NBER Working Paper 14870 [April 2009]

Most Recent Working Paper (may not be identical to the published version)

Published Version (requires subscription)

Additional Materials

(with Sanjay K. Chugh)

Published in Journal of Economic Theory, September 2010, 145(5), 1618-1647.

Contains parts of the now-defunct working paper titled “Money and Optimal Capital Taxation”.

We study optimal fiscal and monetary policy in an environment where explicit frictions give rise to valued money, making money essential in the sense that it expands the set of feasible trades. The two main results are that the Friedman Rule is typically not optimal, and the long-run capital income tax is not zero. Neither of these results is due to any incompleteness of the tax system, as can sometimes occur in standard Ramsey analysis. Rather, by developing a precise notion of margins of adjustment using standard concepts of MRS and MRT, we show that the tax system in our model is complete. The need to distort cash-intensive activity in some sense causes a nonzero capital tax in our model. This deep connection between monetary issues and fiscal policy is in contrast to existing models of jointly-optimal fiscal and monetary policy, in which the monetary aspects of the economic environment have little to do with capital taxation prescriptions. Taken together, these findings reframe some conventional wisdom from baseline Ramsey models.

First Draft : August 2006

Paper

Most Recent Working Paper (may not be identical to the published version)

Published Version (requires subscription)

(with Guillaume Rocheteau and Christopher J. Waller)

Published in Journal of Monetary Economics, November 2007, 54, 2636-2655.

Search models of monetary exchange have typically relied on Nash (1950) bargaining, or strategic games that yield an equivalent outcome, to determine the terms of trade. By considering alternative axiomatic bargaining solutions in a simple search model with divisible money, we show that the properties of the bargaining solutions do matter both qualitatively and quantitatively for questions of first importance in monetary economics such as: (i) the efficiency of monetary equilibrium; (ii) the optimality of the Friedman rule; (iii) the welfare cost of inflation.

Paper

Most Recent Working Paper (may not be identical to the published version)

Published Version (requires subscription)

(with Christopher J. Waller and Randall D. Wright)

Published in Journal of Monetary Economics, March 2011, 58, 98-116

Also circulated as “Money and Capital: A Quantitative Analysis”.

The effects of money (anticipated inflation) on capital formation is a classic issue in macroeconomics. Previous papers adopt reduced-form approaches, putting money in the utility function, or imposing cash in advance, but using otherwise frictionless models. We follow instead a literature that tries to be explicit about the frictions making money essential. This introduces new elements, including a two-sector structure with centralized and decentralized markets, stochastic trading opportunities, and bargaining. These elements matter quantitatively and numerical results differ from findings in the reduced-form literature. The analysis also reduces a gap between microfounded monetary economics and mainstream macro.

First Draft : 2005

Paper

Most Recent Working Paper (may not be identical to the published version)

(with Randall D. Wright)

Published in Journal of Money Credit and Banking, December 2003, 35(6), 1085-1105.

Recent work has reduced the gap between search-based monetary theory and mainstream macroeconomics by incorporating into the search model some centralized markets as well as some decentralized markets where money is essential. This paper takes a further step toward this integration by introducing labor, capital, and neoclassical firms. The resulting framework nests a search-theoretic monetary model and a standard neoclassical growth model as special cases. Perhaps surprisingly, it also exhibits a dichotomy: one can determine the equilibrium path for the value of money independent of the paths of consumption, investment, and employment in the centralized market.

Most Recent Working Paper (may not be identical to the published version)

Published Version (requires subscription)

Discussion by Christopher J. Waller (requires subscription)

Discussion by Peter Howitt (requires subscription)